The Act abolishing adult education benefits has entered into force on 1 June 2024. According to the Act, adult education allowance cannot be obtained under any circumstances for studies starting after 31 July 2024. Read about its effects on applying for adult education allowance on the page News.

How much adult education allowance can I get?

Adult education allowance provides financial security when you study during your career. Learn what all affects the allowance amount and the duration of the allowance period and how you can influence them yourself.

The amount of adult education allowance varies depending on whether you are an employee or an entrepreneur. If you are employed, the amount of adult education allowance you receive depends on your income both before and during your studies.

On the other hand, the amount of entrepreneur’s adult education allowance is fixed. In 2025, it is EUR 660.91 per month. In addition, an entrepreneur can receive income from business activities as well as pay income and benefits for up to three quarters of the amount of allowance.

Adult education allowance is taxable income, whether you are an employee or an entrepreneur. The withholding rate is 20% unless you want to increase or decrease it yourself.

Read more below!

Employed in the private or public sector: What to take into account

If you are employed or planning to take study leave, you can influence your allowance yourself depending on whether you are on full-time or part-time study leave and how much you study and work during each allowance month.

If you work more, you will receive less allowance, but on the other hand, the allowance months will be used more slowly. When you study more and earn less or not at all, the allowance months are used faster, but on the other hand, you get a bigger allowance.

If you do not study the required amount in any given month, or if you receive a lot of other income, you can opt out of the allowance payment, in which case the allowance months will not be spent.

What affects the amount of allowance?

For employed people, the amount of allowance may vary from month to month. The amount of the allowance depends on your average monthly salary before your studies and any other income you may have during the allowance period.

The average monthly pay is determined when you apply for the right to allowance with an allowance right application. It is calculated from the payroll data for the 12 months preceding the application period. This data is generally obtained from the Incomes Register. The average monthly salary is also reduced by the employee's earnings-related pension and unemployment insurance contributions, as well as by the daily allowance payment for the health insurance. In 2024, the amount of deduction is 3.76%.

Your monthly income during the allowance period, in turn, are taken into account in the payment applications you fill out each month. This income includes the wages from your main and secondary activities, some of the statutory benefits and, for example, your additional business income. Data on monthly income are generally obtained from the Incomes Register.

The calculator helps to understand how much adult education allowance you could receive in different situations. Try the calculator!

How is my allowance period used?

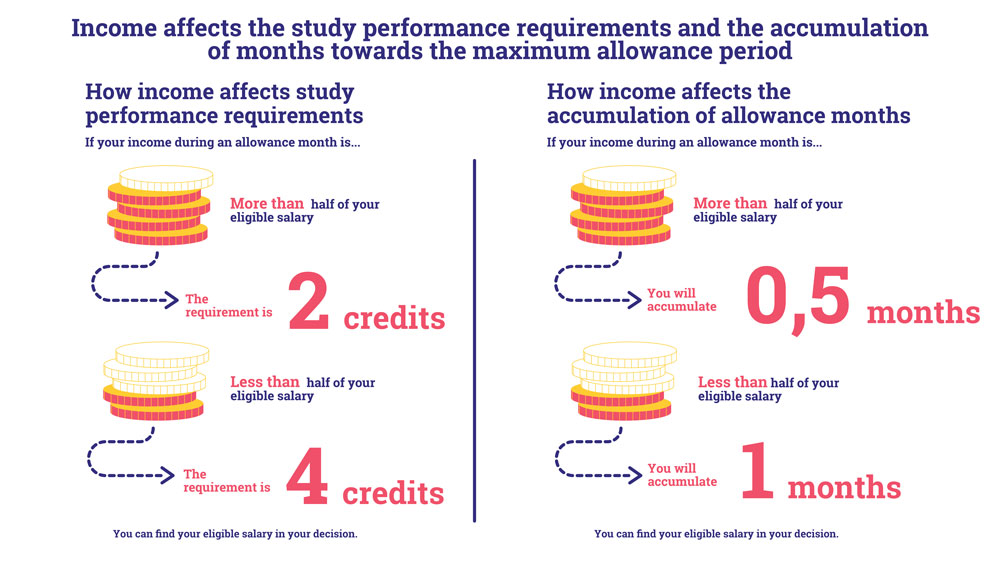

You can receive adult education allowance for up to 15 months. The passage of your support period is affected by how much other income you receive during each allowance month.

If you earn more than half of your normal pay during the allowance month, the allowance period will be half a month. In this case, you must complete 2 credits of studies.

If, on the other hand, you earn less than half of your normal salary during the month of allowance or there is no income at all, the period of allowance lasts for one month and you must complete at least 4 credits.

The amount of allowance is affected by all income paid during the allowance month. In other words, the allowance for the first allowance month may be lower, for example, if your allowance period starts in the middle of a calendar month and you are paid a salary after that.

Read more about scheduling a payment application on the page This is how to apply for adult education allowance.

Frequently asked questions about the amount of employee’s adult education allowance

Unpaid study leave can also have periods shorter than a calendar month, even individual days. In other words, adult education allowance can also be granted for short periods of time.

Remember that income are taken into account according to the time of payment. For example, if the payday is the same as a single study leave day, the pay is considered to be the income received during the allowance period and it reduces the allowance. The amount can also be affected by how much work you do and whether you receive other benefits. See the application instructions on the page This is how to apply for adult education allowance.

The salary on which the earnings component is based is calculated from the established earnings of the employment, service or other employment relationship. The calculation takes into account salary income received in employment or service, but not, for example, bonus holiday pay and holiday compensation or other items that are not established earnings.

Income received in the assignment relationship, as an entrepreneur or as the managing director of a limited company is not taken into account in the calculation. Capital income or other social benefits are also not taken into account.

We generally obtain your salary information from the Incomes Register.

If you have been absent from work during the 12 months prior to your application, either in whole or in part due to family leave, illness, study, unemployment or any other comparable reason, we will extend the reference period by the unpaid or part-time absences, so that the paid 12 months are fulfilled.

The amount of adult education allowance paid is affected by the statutory benefit, salary or other earnings paid to you during the allowance month.

Earnings that affect the amount of allowance are for example:

- Wage and its supplements and earnings equivalent to wage

- Bonus holiday pay and holiday compensation

- Taxable fringe benefits and staff benefits

- Performance-based pay, such as commission, performance bonus and bonus

- Paid days of vacation compensating for longer work days and reduced working time compensation

- Compensation transferred to or withdrawn from the working time bank

- Income received for internship

- Earned income from business activities

- Wage and business income received from abroad.

However, the amount of allowance is not affected by, for example:

- Tax-free allowances, such as mileage allowances, daily allowances

- Income from the staff fund

- Options

- Compensations for acting in a position of trust (e.g. fees for municipal trust positions)

- Family caregiver support

- Family care fee

- Heritage

- Capital income (e.g. Rental income)

- Tax-free scholarship

- Tax return.

Other benefits can affect your adult education allowance in three different ways. The benefit may prevent you from receiving adult education allowance, it may reduce the amount of your allowance, or it may not affect your allowance in any way.

Benefits that prevent the granting of adult education allowance are, for example:

- A study grant or housing supplement in accordance with the Student Aid Act

- Daily allowance under the Health Insurance Act

- Maternity, paternity or parental allowance or partial parental allowance

- Pregnancy allowance (from 1.8.2022)

- Parental allowance (from 1.8.2022)

- Partial parental allowance (from 1.8.2022)

- Special care allowance or special maternity allowance

- Special pregnancy allowance (from 1.8.2022)

- Unemployment benefit or labor market support

- Alternation allowance

- Full invalidity pension or rehabilitation allowance

- Unemployment pension

- Old age pension

- Waiver aid

- Rehabilitation allowance for the same training in accordance with the Act on Rehabilitation Benefits and Rehabilitation Allowances of the Social Insurance Institution or the Employment Pensions Act

- Full rehabilitation allowance under the Accidents at Work and Occupational Diseases Act or the Agricultural Entrepreneur's Accidents at Work and Occupational Diseases Act

- Full compensation for loss of earnings under the provisions of the Act on Rehabilitation Compensable under the Motor Insurance Act or the Military Injury Rehabilitation Act

- Years-of-service pension

- Guarantee pension

You also cannot receive allowance for periods of military service or civil service or imprisonment and study in a penitentiary institution.

Benefits that affect the amount of adult education allowance include, for example:

- Support for children's home care, i.e. care allowance and care supplement (without municipal supplement)

- Flexible care allowance and partial care allowance

- Partial invalidity pension

- Part-time pension

- Rehabilitation allowance not granted for the same training

The following benefits do not affect adult education allowance:

- Child benefit

- Survivors' pensions

- Income support

- School transport subsidy

- Family caregiver support

- Family care fee

- Compensation for functional limitation

- Disability allowance

- General or pensioner's housing allowance

- Care allowance for a pensioner

- Military assistance

- Partial early retirement pension

- Student loan

The income of the spouse does not affect the amount of the allowance in any way, nor does it affect entitlement to the allowance. Allowance is also not affected by the situation of the family or the number of children.

As a beneficiary of the adult education allowance, you may be entitled to a State guarantee for a student loan. Kela processes applications for State guarantees and grants such guarantees.

To receive a guarantee decision you can apply to a bank for a student loan and agree on the terms of the loan and the repayment schedule with the bank.

Send your guarantee application directly to Kela.

Further information on student loans, see Kela's Student loan for adult students page.

The student loan is not considered as income and it does not affect your amount of adult education support.

Your normal salary before your studies (gross €/month)

| Income gross €/month | 500 | 1000 | 1500 | 2000 | 2500 | 3000 | 3500 | 4000 | 4500 | 5000 |

| - | 660,91 | 784,85 | 985,61 | 1185,37 | 1387,13 | 1587,89 | 1694,99 | 1790,59 | 1886,19 | 1981,79 |

| 250 | 535,91 | 659,85 | 860,61 | 1061,37 | 1262,13 | 1462,89 | 1569,99 | 1665,59 | 1761,19 | 1856,79 |

| 500 | 410,91 | 456 | 735,61 | 936,37 | 1137,13 | 1337,89 | 1444,99 | 1540,59 | 1636,19 | 1731,79 |

| 750 | 285,91 | 285,91 | 610,61 | 811,37 | 1012,13 | 1212,89 | 1319,99 | 1415,59 | 1511,19 | 1606,79 |

| 1000 | 160,91 | 160,91 | 434 | 686,37 | 887,13 | 1087,89 | 1194,99 | 1290,59 | 1386,19 | 1481,79 |

| 1250 | 35,91 | 184 | 561,37 | 762,13 | 962,89 | 1069,99 | 1165,59 | 1261,19 | 1356,79 | |

| 1500 | 412 | 637,13 | 837,89 | 944,99 | 1040,59 | 1136,19 | 1231,79 | |||

| 1750 | 162 | 512,13 | 712,89 | 819,99 | 915,59 | 1011,19 | 1106,79 | |||

| 2000 | 387,13 | 587,89 | 649,99 | 760,59 | 886,19 | 981,79 | ||||

| 2250 | 140 | 462,89 | 569,99 | 665,59 | 761,19 | 856,79 | ||||

| 2500 | 337,89 | 444,99 | 540,59 | 636,19 | 731,79 | |||||

| 2750 | 118 | 319,99 | 415,59 | 601,19 | 606,79 | |||||

| 3000 | 194,99 | 290,59 | 386,19 | 481,79 | ||||||

| 3250 | 69,99 | 165,59 | 216,19 | 356,79 | ||||||

| 3500 | 40,59 | 136,19 | 231,79 |

Entrepreneur: Take these into account

As an entrepreneur, you will receive a fixed amount of adult education allowance. In 2024, the amount will be EUR 660.91 per month (gross). You can also earn income from your business, as long as your income is reduced by at least a third compared to the last taxation confirmed before you started studying. You will receive information with the payment notification on how much income you can earn from business at most during the allowance period.

You can receive non-business income as additional income for a maximum of three quarters of the amount of allowance to be paid, i.e. in 2023, a maximum of EUR 495.68 (gross) per month. Outside the allowance period, you are free to earn income from both your business activities and as an additional income from paid work elsewhere, for example. The allowance period shall not exceed 15 months.

You can receive adult education allowancce for a maximum of 15 months, for a total of 322.5 allowance days. One full allowance month consumes 21.5 allowance days. You can also cancel allowance months depending on your situation. They will not be automatically available to you later, but you can re-apply for them with a further application.

The studies should proceed during the allowance months so that you complete at least 3 credits of study or competence or 1,8 credits per allowance month. If the scope of your studies is not defined in terms of credits, competence points or study weeks, the scope of the studies and the pace of progress of the studies as defined by the educational institution must average at least 15 hours per week.

To be eligible for entrepreneur’s adult education education allowance, your business income must be reduced by at least one-third during the allowance period compared to the last taxation confirmed before you started studying.

You must indicate in your application, what arrangements in entrepreneurship during your education will lead to a one-third reduction in your business income. Business income should decline due to education.

We will state in the payment notice, what is the upper limit of how much you can receive business income during your allowance period.

We will investigate the reduction in your taxable income from business activities retrospectively when the taxation is completed for the year in which the allowance was paid. We cannot investigate in the middle of the year, whether the business income reduction has materialized. If you wish, you can cancel the adult education allowance in advance, if it appears that the reduction of income will not materialize for all the allowance months.

If the tax details received by the Employment Fund show directly that your income from business activities has decreased by at least one third, you will receive a decision confirming that the allowance was granted for the year in question.

If the decrease in earnings is not directly evident based on the tax details, you will be sent a hearing letter, which you can respond to with a plea and the necessary clarifications. The hearing letter will contain information stating which clarifications we require.

If your earnings from business activities have not decreased by at least one third, your allowance application will be rejected and any adult education allowance paid without grounds for the year in question will be recovered in full.

Example: You have applied for an adult education allowance for the period from 1 September to 31 December 2022. In the most recent taxation information before your application, your income from business activities was EUR 36,000, which averages EUR 3,000 per month. During the allowance period, you may earn a maximum average of EUR 2,000 (gross) per month from business activities. Capital income is not taken into consideration.

During the allowance period, you can receive earned income from your non-business activities up to three quarters of the amount of allowance to be paid, i.e. up to EUR 495.68 (gross) per month in 2024.

In addition to wage and other earned income, some statutory benefits are also considered as additional income, such as support for home care for children without a municipal supplement, partial care allowance, family care support and a partial disability pension. Also, a tax refund or capital income do not affect adult education allowance.

The income limit applies to the time you receive adult education allowance. Outside the allowance period, you can earn freely. Note, however, that earnings are always reviewed according to the payment date.

The income of the spouse does not affect the amount of the allowance in any way, nor does it affect entitlement to the allowance. Allowance is also not affected by the situation of the family or the number of children.

Benefits that prevent the granting of adult education allowance are, for example:

- A study grant or housing supplement in accordance with the Student Aid Act

- Daily allowance under the Health Insurance Act

- Maternity, paternity or parental allowance or partial parental allowance

- Special care allowance or special maternity allowance

- Unemployment benefit or labor market support

- Alternation allowance

- Full invalidity pension or rehabilitation allowance

- Unemployment pension

- Old age pension

- Waiver aid

- Rehabilitation allowance for the same training in accordance with the Act on Rehabilitation Benefits and Rehabilitation Allowances of the Social Insurance Institution or the Employment Pensions Act

- Full rehabilitation allowance under the Accidents at Work and Occupational Diseases Act or the Agricultural Entrepreneur's Accidents at Work and Occupational Diseases Act

- Full compensation for loss of earnings under the provisions of the Act on Rehabilitation Compensable under the Motor Insurance Act or the Military Injury Rehabilitation Act

- Years-of-service pension

- Guarantee pension

You also cannot receive allowance for periods of military service or civil service or imprisonment and study in a penitentiary institution.

As a beneficiary of the adult education allowance, you may be entitled to a State guarantee for a student loan. Kela processes applications for State guarantees and grants such guarantees.

To receive a guarantee decision you can apply to a bank for a student loan and agree on the terms of the loan and the repayment schedule with the bank.

Send your guarantee application directly to Kela.

Further information on student loans, see Kela's Student loan for adult students page.